What Is Considered A Combined Group Texas Franchise Tax . Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. Entities have to file a combined franchise tax return if they are part of a combined group. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. A combined group is two or more.

from www.templateroller.com

In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. A combined group is two or more. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. Entities have to file a combined franchise tax return if they are part of a combined group.

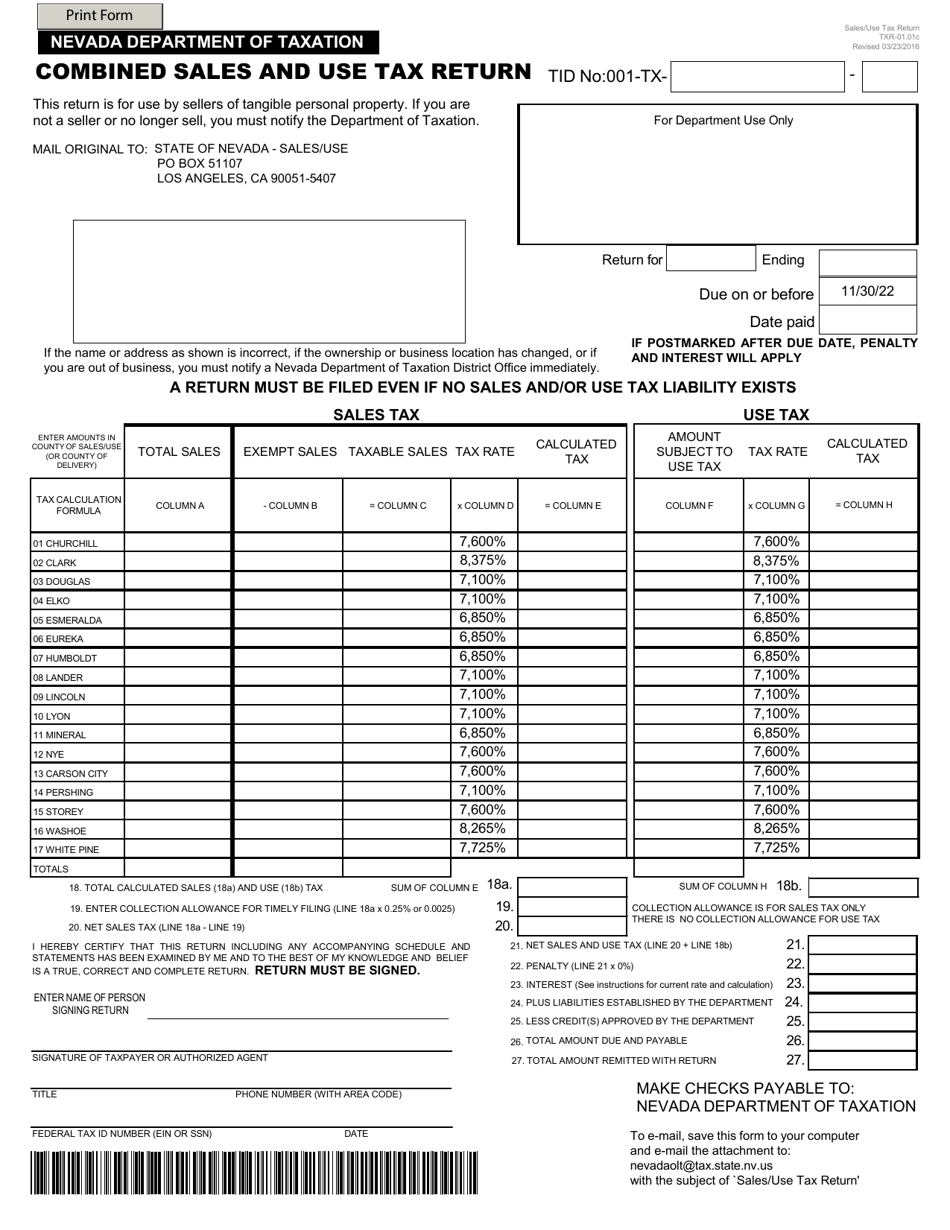

Form TXR01.01C Download Fillable PDF or Fill Online Combined Sales and

What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. Entities have to file a combined franchise tax return if they are part of a combined group. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? A combined group is two or more. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002.

From www.slideshare.net

Combined Group Business Enterprise Tax Return What Is Considered A Combined Group Texas Franchise Tax In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. A combined group is two or more. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? (a) a combined group may. What Is Considered A Combined Group Texas Franchise Tax.

From www.templateroller.com

Form CBT100U Schedule X Fill Out, Sign Online and Download Printable What Is Considered A Combined Group Texas Franchise Tax In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. Do the tiered partnership provisions apply if some of. What Is Considered A Combined Group Texas Franchise Tax.

From franchise-faq.com

How To File Texas Franchise Tax Report What Is Considered A Combined Group Texas Franchise Tax Entities have to file a combined franchise tax return if they are part of a combined group. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. (a) a combined group may not include a taxable entity that conducts business outside the united. What Is Considered A Combined Group Texas Franchise Tax.

From www.templateroller.com

Form 4 (IC040) Download Fillable PDF or Fill Online Wisconsin Non What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are. What Is Considered A Combined Group Texas Franchise Tax.

From franchise-faq.com

How To File Franchise Tax Report What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. An affiliated group is a group of one or more entities (with or without nexus in texas). What Is Considered A Combined Group Texas Franchise Tax.

From timramos392news.blogspot.com

Sub Finance Meaning What Is Considered A Combined Group Texas Franchise Tax An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. (a) a combined group may not include a taxable entity that conducts business outside the united. What Is Considered A Combined Group Texas Franchise Tax.

From clubadventist.com

How Billionaires Got So Powerful Politics (Mainly US) and other What Is Considered A Combined Group Texas Franchise Tax An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. A combined group is two or more. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity.. What Is Considered A Combined Group Texas Franchise Tax.

From www.formsbank.com

Form Ct3A/c Report By A Corporation Included In A Combined What Is Considered A Combined Group Texas Franchise Tax Entities have to file a combined franchise tax return if they are part of a combined group. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part. What Is Considered A Combined Group Texas Franchise Tax.

From studylib.net

Combined Reporting for Texas Franchise Tax What Is Considered A Combined Group Texas Franchise Tax (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? A combined group is two or more. An affiliated group is a group. What Is Considered A Combined Group Texas Franchise Tax.

From itep.org

Texas Who Pays? 6th Edition ITEP What Is Considered A Combined Group Texas Franchise Tax The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or. What Is Considered A Combined Group Texas Franchise Tax.

From www.formsbank.com

Form Ct32A Banking Corporation Combined Franchise Tax Return 2013 What Is Considered A Combined Group Texas Franchise Tax Entities have to file a combined franchise tax return if they are part of a combined group. The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a. What Is Considered A Combined Group Texas Franchise Tax.

From www.signnow.com

Report by a Corporation Included in a Combined Franchise Tax Tax Ny What Is Considered A Combined Group Texas Franchise Tax The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. Entities have to file a combined franchise tax return if they are part of a combined group. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock. What Is Considered A Combined Group Texas Franchise Tax.

From www.reddit.com

U.S. Sales Tax by State [1484x1419] MapPorn What Is Considered A Combined Group Texas Franchise Tax The combined group is a single taxable entity for purposes of the application of the tax imposed under this chapter, including section 171.002. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. (a) a combined group may not include a taxable entity. What Is Considered A Combined Group Texas Franchise Tax.

From www.formsbank.com

Fillable Form 4r Federal Taxable Reconciliation For Wisconsin What Is Considered A Combined Group Texas Franchise Tax An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. A combined group is two or more. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity.. What Is Considered A Combined Group Texas Franchise Tax.

From texashistory.unt.edu

Tax Information Franchise Tax Reporting Tips for Combined Groups What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. An affiliated group is a group of one or more entities (with or without nexus in texas) in which a controlling interest (more than 50%) is owned. The combined group is a single taxable entity for purposes of the application of the tax. What Is Considered A Combined Group Texas Franchise Tax.

From www.formsbank.com

Form Fae 174 Franchise And Excise Financial Institution Tax Return What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more of the taxable entity's. Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part. What Is Considered A Combined Group Texas Franchise Tax.

From www.patriotsoftware.com

Sales Tax vs. Use Tax How They Work, Who Pays, & More What Is Considered A Combined Group Texas Franchise Tax The texas comptroller of public accounts released answers to frequently asked questions regarding the state’s franchise tax,. In determining which entities must be included in a combined group, is an individual ever considered the owner of stock or of interest in an entity. The combined group is a single taxable entity for purposes of the application of the tax imposed. What Is Considered A Combined Group Texas Franchise Tax.

From guineverewcatha.pages.dev

Texas Corporate Tax Rate 2024 Vonny What Is Considered A Combined Group Texas Franchise Tax Do the tiered partnership provisions apply if some of the entities in the tiered partnership arrangement are part of a combined group? Entities have to file a combined franchise tax return if they are part of a combined group. (a) a combined group may not include a taxable entity that conducts business outside the united states if 80% or more. What Is Considered A Combined Group Texas Franchise Tax.